Revision of Depreciation On January 2, 2015, Moser, Inc., purchased equipment for $100,000. The equipment useful life. Straight-line depreciation has been recorded. Before adjusting the accounts for 2019, Moser decided that the useful life of the equipment should be was expected to have a $10,000 salvage value at the end of its estimated six-year extended by three years and the salvage value decreased to $8,000. |a. Prepare a journal entry to record depreciation expense on the equipment for 2019. Round your answer to the nearest dollar. General Journal Debit Credit 0 Dec. 31 To record depreciation expense. b. What is the book value of the equipment at the end of 2019 (after recording the depreciation expense for 2019)? Book Value at year ended December 31, 2019: $

Answers

In the following question, among the various parts to solve in Depreciation- a- available in the main answer, b. the book value of the equipment at the end of 2019 (after recording the depreciation expense for 2019) is $89,778.

a. Prepare a journal entry to record depreciation expense on the equipment for 2019The journal entry to record depreciation expense on the equipment for 2019 is shown below:

General Journal Debit CreditDepreciation Expense ($100,000 - $8,000)/9) 10,222Accumulated Depreciation-Equipment10,222

The entry above is the depreciation expense of $10,222 for 2019 (rounded to the nearest dollar),

calculated using the straight-line method. The total cost of the equipment was $100,000, and it has a salvage value of $8,000. Moser, Inc.

believed that the useful life of the equipment should have been extended by three years, resulting in a useful life of nine years.

b. What is the book value of the equipment at the end of 2019 (after recording the depreciation expense for 2019)?Book value at the year ended December 31, 2019, is calculated as follows: Book Value = Cost - Accumulated DepreciationBook Value = $100,000 - $10,222Book Value = $89,778Therefore, the book value of the equipment at the end of 2019 (after recording the depreciation expense for 2019) is $89,778.

For more such questions on Depreciation

https://brainly.com/question/25785586

#SPJ11

Related Questions

3) Real GDP per capita is $40,000 and grows by 2% per year. According to the rule of 70, how many years will it take for real GDP per capita to double? How long will it actually take for real GDP per capita to double? (Use Excel) 4) Real GDP per capita is $40,000 and grows by 3% per year. According to the rule of 70, how many years will it take for real GDP per capita to double? How long will it actually take for real GDP per capita to double? (Use Excel)

Answers

The rule of 70 states that if the annual growth rate of a variable (such as GDP or population) is x%, then that variable will double in approximately 70/x years.

Real GDP per capita is $40,000 and grows by 2% per year, so the annual growth rate is 2%.

To calculate how many years it will take for real GDP per capita to double, we can use the rule of 70:70/2 = 35Therefore, it will take approximately 35 years for real GDP per capita to double.

To calculate how long it will actually take for real GDP per capita to double, we can use the formula for compound interest:

A = P(1 + r/n)^(nt)where A is the final amount, P is the principal, r is the annual interest rate, n is the number of times the interest is compounded per year, and t is the number of years. For this problem, we can assume that P = $40,000, r = 2%, n = 1 (since the interest is compounded annually), and A = 2P = $80,000. Plugging these values into the formula, we get:80,000 = 40,000(1 + 0.02/1)^(1t)Simplifying:2 = (1.02)^t.

Taking the natural logarithm of both sides:

ln(2) = t ln(1.02)Solving for t: t = ln(2) / ln(1.02)≈ 35.0Therefore, it will take approximately 35 years for real GDP per capita to double.4) Real GDP per capita is $40,000 and grows by 3% per year, so the annual growth rate is 3%.

To calculate how many years it will take for real GDP per capita to double, we can use the rule of 70:70/3 = 23.33 (rounded to two decimal places)Therefore, it will take approximately 23.33 years for real GDP per capita to double.

To calculate how long it will actually take for real GDP per capita to double, we can use the same formula as before: A = P(1 + r/n)^(n t)where A is the final amount, P is the principal, r is the annual interest rate, n is the number of times the interest is compounded per year, and t is the number of years.

For this problem, we can assume that P = $40,000, r = 3%, n = 1 (since the interest is compounded annually), and A = 2P = $80,000.

Plugging these values into the formula, we get:80,000 = 40,000(1 + 0.03/1)^(1t)Simplifying:2 = (1.03)^t

Taking the natural logarithm of both sides: ln(2) = t ln(1.03)Solving for t: t = ln(2) / ln(1.03)≈ 22.62

Therefore, it will actually take approximately 22.62 years for real GDP per capita to double.

Learn more about GDP:

https://brainly.com/question/1383956

#SPJ11

Last year real GDP in the imaginary nation of Oceania was 561. 0 billion and the population was 2. 2 million. The year before, real GDP was 500. 0 billion and the population was 2. 0 million. What was the growth rate of real GDP per person during the year?

Answers

The growth rate of real GDP per person during the year in Oceania was 2.0%.

To calculate the growth rate of real GDP per person in Oceania during the year, we need to first calculate the real GDP per person for each year.

For the current year:

Real GDP per person = 561.0 billion / 2.2 million = $255,000

For the previous year:

Real GDP per person = 500.0 billion / 2.0 million = $250,000

Next, we can calculate the growth rate of real GDP per person using the following formula:

Growth rate = (Current year's real GDP per person - Previous year's real GDP per person) / Previous year's real GDP per person * 100%

Substituting the values we calculated earlier, we get:

Growth rate = ($255,000 - $250,000) / $250,000 * 100% = 2.0%

To know more about GDP, click here.

https://brainly.com/question/31197617

#SPJ4

How should you dress for a phone interview? (Site 1)

online content

Answers

Answer:

You should at least have a nice top on because only the camera will see that. If you are a girl you could just wear a dress, probably a black one because that is what I wore to my interview yesterday because there is no pattern or anything it's just a plain black one, but that was in person. if you're a guy you need to wear a suit and tie,but you could probably just wear shorts because they won't see the bottom half of you

Explanation:

I hope this helps out a little bit :-)

An interview is a formal process by which an employee is assessed for his/her performance by the employer.

For a phone interview, one should be dressed properly as the interviewer can see you through the camera.

For a girl, you should be dressed nicely and no revealing or extra shiny clothes should be wore.

In the case of a man, one should be properly dressed in suits or formal shirts.

Try to wear dark black or blue coloured clothes and sit in a properly lighted area.

To learn more about phone interviews follow the link:

https://brainly.com/question/3701296

The Quaint Quilt produces and sells handmade quilts. Variable manufacturing costs total $140 per quilt. Fixed manufacturing overhead totals $68,250 per quarter. Variable selling and administrative costs are $19 per quilt sold, and fixed selling and administrative costs are $50,000 per quarter. Last quarter, the company produced 910 quilts and sold 780 quilts. The total variable cost reported on Quaint Quilt's variable costing income statement is

Answers

The total variable cost reported on Quaint Quilt's variable costing income statement is: $124,020

Calculation to determine the total variable costing income statement

Using this formula

Variable costing income statement=(Variable manufacturing costs+Variable selling and administrative costs )×Sales

Let plug in the formula

Variable costing income statement($140 + $19) x 780 quilts sold

Variable costing income statement=$159×780 quilts sold

Variable costing income statement=$124,020

Inconclusion The total variable cost reported on Quaint Quilt's variable costing income statement is: $124,020.

Learn more here:

https://brainly.com/question/13214374

Name TWO organisations which typically offer

loans to small businesses.

Answers

Answer:

Kabbage: Best Overall.

Fundbox: Best Revolving Line of Credit

Explanation:

An architect’s functions may include which of the following? (SELECT ALL THAT APPLY.)

-planning and designing houses, commercial buildings, and other structures

-ensuring worksite safety

-collaborating with engineers

-acting as a construction manager and supervising contractors

Answers

Answer:

the answer is planning, ensuring, and acting

The activities of the federal reserve board have the most direct influence on.

Answers

Answer:

The activities of the Federal Reserve Board have the most direct influence on: bank interest rates, monetary policy (interest rates, credit, etc.)

which one of the following statements best describes a "selling point" as identified in quality function deployment process?A. a price level (price per unit) for a product at which its sell volume increases abruptlyB. it is another name used for break-even pointC. it is a point (e.g., a store, an internet site, etc.) where a product is soldD. an important customer requirement which is not met by the competitors' products

Answers

D. An important customer requirement which is not met by the competitors' products is the best description of a "selling point" as identified in the quality function deployment process.

D. An important customer requirement which is not met by the competitors' products is the best description of a "selling point" as identified in the quality function deployment process. A selling point is a feature or benefit of a product that sets it apart from its competitors and makes it more attractive to customers. It is something that customers value and are willing to pay for, and it gives the product a competitive advantage in the market. Identifying and prioritizing selling points is a key part of the quality function deployment process, which helps to ensure that customer needs and wants are met through the design and production of high-quality products.

Learn more about function here

https://brainly.com/question/12431044

#SPJ11

Cash flows from________ activities include both inflows and outflows of cash from the external funding of a business.

Answers

Cash flows from Operating activities include both inflows and outflows of cash from the external funding of a business.

The phrase "cash inflow" is used to describe the money that enters a company. It could come from borrowing, investments, or sales. Since a cash influx entails money entering a business, it is the reverse of a cash outflow. Focus is placed on a company's operating cash flows, which include cash inflows and outflows connected to its core business operations like the sale and purchase of inventory, the provision of services, and the payment of salaries.

The cash flow statement details cash inflows and outflows whereas the income statement details revenue and expenses. A cash flow statement shows liquidity whereas an income statement shows profitability. Cash inflows are a component of numerous sources of revenue. Normally, revenue is generated through the sale of cattle and crops.

To know more about external funds visit :

brainly.com/question/29217138

#SPJ4

Which type of savings plan offers the lowest interest rate?

A.

Checking account

B.

Money market account

C.

Savings account

D.

Certificate of deposit

Answers

ermanent disability refers to an ill or injured employee’s __________ capacity to return to work.

Answers

Permanent disability refers to an ill or injured employee's diminished or lost capacity to return to work.

When an employee experiences a permanent disability, it means that their illness or injury has resulted in a long-term or permanent inability to return to work. This disability can be physical, mental, or a combination of both, and it significantly impacts the individual's functional abilities and capacity to perform their job duties.

The determination of permanent disability is typically based on medical assessments and evaluations. Healthcare professionals, such as doctors or specialists, assess the employee's condition, review medical records, and conduct examinations to determine the extent of the disability and its expected duration. They consider factors such as the nature of the illness or injury, the prognosis for recovery, the individual's ability to engage in work-related activities, and the impact on their overall quality of life.

In legal and workers' compensation contexts, the determination of permanent disability is crucial in assessing the employee's eligibility for benefits and compensation. Depending on the jurisdiction and applicable laws, permanent disability may entitle the employee to ongoing financial support, medical care, vocational rehabilitation, and other assistance programs.

Learn more about Disability: https://brainly.com/question/27806197

#SPJ11

Gina is about to use a fire extinguisher on a small fire.

What factor determines the type of extinguisher she

should use?

Answers

Dividend reinvestment plans Dividend reinvestment plans (DRIPs) allow shareholders to reinvest their dividends in the company itself by purchasing additional shares rather than being paid out in cash. Understanding how dividend reinvestment plans work Under an old stock a new stock dividend reinvestment plan, the company gives any cash dividends that investors would have received to a bank, which acts as a trustee. The bank then uses the money to repurchase the company's stock on the open stock market. The bank allocates the shares purchased to the participating stockholders' accounts on a pro rata basis. Low High levels of participation in a dividend reinvestment program suggest that stockholders would be better served if the firm reduced its cash dividends. Why do firms use dividend reinvestment plans? Companies decide to start, continue, or terminate their dividend reinvestment plans for their stockholders based on the firms' need for equity capital. A firm is likely to start using new stock DRIPs if it needs doesn't need additional equality capital.

Answers

A dividend reinvestment plan (DRIP) is a program offered by companies that allows shareholders to reinvest their dividends by purchasing additional shares of the company's stock instead of receiving cash dividends.

Instead of paying out dividends in cash, the company directs the cash dividends to a trustee bank, which uses the funds to repurchase the company's stock on the open market. The purchased shares are then allocated to participating shareholders' accounts proportionally.

High levels of participation in a dividend reinvestment program can indicate that stockholders prefer to reinvest their dividends in the company rather than receiving cash. This suggests that the firm may consider reducing its cash dividends and using the funds for other purposes, such as reinvesting in the business or paying down debt.

Companies utilize dividend reinvestment plans for various reasons. One primary reason is to provide an attractive option for shareholders who want to increase their ownership in the company over time. DRIPs can help foster long-term shareholder loyalty and encourage investment in the company's stock. Additionally, by reinvesting dividends back into the company, firms can utilize the funds for capital expansion, research and development, or other strategic initiatives, which can benefit both the company and its shareholders.

Know more about dividend reinvestment plan here:

https://brainly.com/question/29832712

#SPJ11

Which of the following generates pressure to decrease inventories?A) inventory shrinkage costsB) backorders and stockoutsC) transportation costsD) quantity discounts

Answers

Inventory shrinkage costs generates pressure to decrease inventories. Correct option is A.

The first policy choice is through a system called a fixed- order volume system. thus, two variables define this system and answer the two introductory questions of when to order and how important. The first is an order volume, Q, and the second is a reorder point, ROP. As the name suggests, the volume ordered with this system is constant or fixed and is denoted by Q. An order is placed when the force position drops to some predetermined position. This predetermined position is called the reorder point and is generally noted as ROP. Together these variables specify when to place an order when force reaches the ROP. They also specify how important to order the volumeQ.

To know more about Inventory shrinkage:

https://brainly.com/question/13401621

#SPJ4

Using productivity software ensures that the end product will look professional.

Answers

Answer: false

Explanation:

on edge 2021

Answer: The answer is false

Explanation:

props to the other dude, give them brainliest

Your client, Lana Kayne, was born and raised in the U.S., though she spent time overseas while serving in the military several years ago. Which of the following circumstances may complicate her income tax planning for 2015?

a. Her employer is based in Belgium.

b. She married a foreign national in 2015.

c. After selling her U.S.-based customs consulting business in February, she "took some time off" and traveled overseas for 8 months.

d. She maintains $5,000 in a Swiss bank account for when she travels overseas.

Answers

The circumstances that may complicate Lana Kayne's income tax planning for 2015 are:

a. Her employer is based in Belgium.

b. She married a foreign national in 2015.

c. After selling her U.S.-based customs consulting business in February, she "took some time off" and traveled overseas for 8 months.

d. She maintains $5,000 in a Swiss bank account for when she travels overseas.

These circumstances may complicate her tax planning because they involve international elements such as foreign employment, marriage to a foreign national, extended overseas travel, and the possession of funds in a foreign bank account, which could have implications for her U.S. tax obligations and reporting requirements.

Learn more about bank account, here:

https://brainly.com/question/31594857

#SPJ11

For each lease below identify whether the short-term lease recognition exemption would be available. Fill in the columns by dragging and dropping the options from below, and then select Submit.

Answers

Here is the analysis of whether the short-term lease recognition exemption would be available for each lease:

How to explain the leaseLease 1: Lease term: 11 months

Option to purchase: No

The short-term lease recognition exemption would be available for this lease because the lease term is 12 months or less and there is no option to purchase the underlying asset.

Lease 2:Lease term: 10 months

Option to purchase: Yes, but the lessee is not reasonably certain to exercise the option.

The short-term lease recognition exemption would be available for this lease because the lease term is 12 months or less and the lessee is not reasonably certain to exercise the option to purchase the underlying asset.

Lease 3: Lease term: 11 months

Option to purchase: Yes, and the lessee is reasonably certain to exercise the option.

The short-term lease recognition exemption would not be available for this lease because the lease term is 12 months or less, but the lessee is reasonably certain to exercise the option to purchase the underlying asset.

Learn more about lease on

https://brainly.com/question/30237244

#SPJ4

which type of leadership style should be used when the group has a strong sense of teamwork and a familiar routine?

Answers

When the group has a strong sense of teamwork and a familiar routine, a delegative or participative leadership style is often most effective.

In a delegative leadership style, the leader gives the group a high degree of autonomy, delegating decision-making responsibility to the team members. In a participative leadership style, the leader actively involves team members in the decision-making process, creating a sense of shared responsibility for the outcome. Both styles allow the team to take ownership of the work, build trust and cooperation, and leverage the team's strengths and experience. This type of leadership style also creates a legislation environment where team members feel valued and empowered, which can lead to higher levels of job satisfaction and motivation. so, a delegative or participative leadership style is often most effective.

learn more about legislation here

https://brainly.com/question/14439231

#SPJ4

if you have a long-term goal of saving for your child's tuition, a liquid account does not need to be considered. True or false

Answers

False. A liquid account should be considered when saving for a long-term goal such as your child's tuition.

A liquid account is a type of account that allows you to access funds quickly and easily. Liquid accounts are often low risk investments and come with benefits such as tax benefits, higher interest rates, and the ability to make contributions at any time. With a liquid account, you can save money over the long-term, which can help you reach your goal of saving for your child's tuition. You should consider how much money you can save each month and how long it will take you to reach your goal before deciding on the type of liquid account that will work best for you. Additionally, you should research different liquid account options to ensure you get the best rate of return on your investments.

Ultimately, a liquid account can help you reach your long-term goal of saving for your child's tuition.

For more such questions on liquid account

https://brainly.com/question/7644266

#SPJ11

an apartment building must have a resident property manager if the building has

Answers

An apartment building must have a resident property manager if the building requires on-site management for tasks such as property maintenance, tenant relations, and compliance with regulations.

An apartment building must have a resident property manager if the building has specific requirements or regulations that necessitate on-site management, such as maintaining the property, addressing tenant concerns, coordinating repairs and maintenance, ensuring compliance with local laws and regulations, and handling day-to-day operations.

Having a resident property manager offers several benefits for both the property owner and the tenants. The property manager can handle tenant screening and selection, lease agreements, rent collection, and tenant relations, ensuring a smooth and efficient rental process.

They can also address maintenance issues promptly, ensuring that the building is well-maintained and tenants' needs are met.

Additionally, a resident property manager can act as a point of contact for emergencies, security concerns, and general inquiries, providing a sense of security and convenience for the residents. They can also enforce property rules and regulations, handle disputes or conflicts among tenants, and maintain a safe and comfortable living environment.

Having a resident property manager is especially crucial for larger apartment buildings or complexes with a significant number of units. The scale and complexity of managing such properties require an on-site manager who can oversee the various tasks and responsibilities involved.

For more question on resident visit:

https://brainly.com/question/29219809

#SPJ8

The controlled substances act requires each registrant to make a complete and accurate record of all stocks of controlled substances on hand every ____ year(s).

Answers

The Controlled Substances Act (CSA) requires each registrant to make a complete and accurate record of all stocks of controlled substances on hand every two years.

This record is known as an inventory and serves as an important regulatory requirement to ensure accountability and prevent diversion of controlled substances. Conducting a regular inventory helps maintain accurate records of the quantities and types of controlled substances held by the registrant. It assists in identifying any discrepancies or potential issues, such as theft, loss, or improper handling of controlled substances. By mandating a biennial inventory, the CSA aims to promote compliance, enhance drug control measures, and protect public health and safety by ensuring the secure management of controlled substances.

To know more about Controlled Substances Act:

https://brainly.com/question/32246253

#SPJ4

Who do YOU like more

Joseph Biden or Donald Trump?

Please answer with you honest opinion.

Answers

Answer:

Explanation:

Joseph biden

the _____ the worker, ceteris paribus, the greater the _____ cost of attending college.

Answers

The higher the wage rate of the worker, ceteris paribus, the greater the opportunity cost of attending college.

Opportunity cost refers to the potential benefits or value that is forgone when an individual, organization, or society chooses one option or course of action over another. It is the fundamental principle of economics that recognizes the scarcity of resources and the need to make choices.

When a decision is made, the opportunity cost is the value of the next best alternative that could have been chosen instead. It represents the benefits, profits, or satisfaction that could have been obtained from that alternative choice. For example, if a person decides to invest their money in stocks instead of real estate, the opportunity cost is the potential gains they could have made from the real estate investment.

To know more about Opportunity cost refer to-

brainly.com/question/31580865

#SPJ4

flora Quinton is buying a new air compressor for her auto repair shop. it sells for $1,299. She makes a down payment of $199 and finances the remainder. How much does she finance?

Answers

Answer:

$1,100

Explanation:

flora Quinton is buying a new air compressor for her auto repair shop. it sells for $1,299. She makes a down payment of $199 and finances the remainder. How much does she finance?

1,299 - 199 = 1,100

Which kind of bond pays interest which is exempt from tax? a. treasury bonds b. junk bonds c. municipal bonds d. corporate bonds please select the best answer from the choices provided a b c d

Answers

Option (c): Municipal bonds are a type of bond that pay tax-free interest.

What are tax-free bonds, exactly?The government offers bonds that are not subject to tax in order to raise money for a variety of purposes. Because it delivers a fixed interest rate, this low-risk investment option is the best one. Similar to a fixed deposit, an investor can put a sizable sum of money in a tax-free bond in exchange for a fixed rate of interest.

Tax-free interest on municipal bonds?Federal taxes are typically not due on municipal bonds' (also known as munis') income. Municipal bonds are issued by state, local, and city governments. However, when you file your taxes, you will need to disclose this income.

In some situations, municipal bonds are also exempt from state and local taxes. Municipal bonds are not subject to federal taxes. Consequently, based on where you live, you could never have to pay income taxes on the payments you get from the bond's issuer (but they may be subject to the alternative minimum tax or AMT).

Learn more about Municipal bonds: https://brainly.com/question/13448929

#SPJ4

what activities would a product under typically undertake in the period between the end of a current sprint

Answers

The only activity team members typically do between sprint review and sprint planning is sprint lookback.

Set current sprint?

Sprints are finite periods of one week to one month in which the Product Owner, Scrum Master, and Scrum Team work to complete the addition of a specific product. Throughout the sprint, work continues to create new features based on user stories and the backlog. A new sprint begins immediately after the end of the current sprint.The Sprint is a short period of time in which the Scrum Team works to get a specific amount of work done. Sprints are at the heart of Scrum and Agile methods, and executing them properly will help your Agile team deliver better software with fewer problems. At the sprint planning meeting, the team (including the Scrum Master, Scrum Product Manager, and Scrum Team) meets to determine which backlog items will be covered in the next sprint.

The sprint planning ceremony in Scrum is a collaborative process that allows team members to have their say while the work is being done.

To learn more about current sprint refers to:

brainly.com/question/4799089

#SPJ4

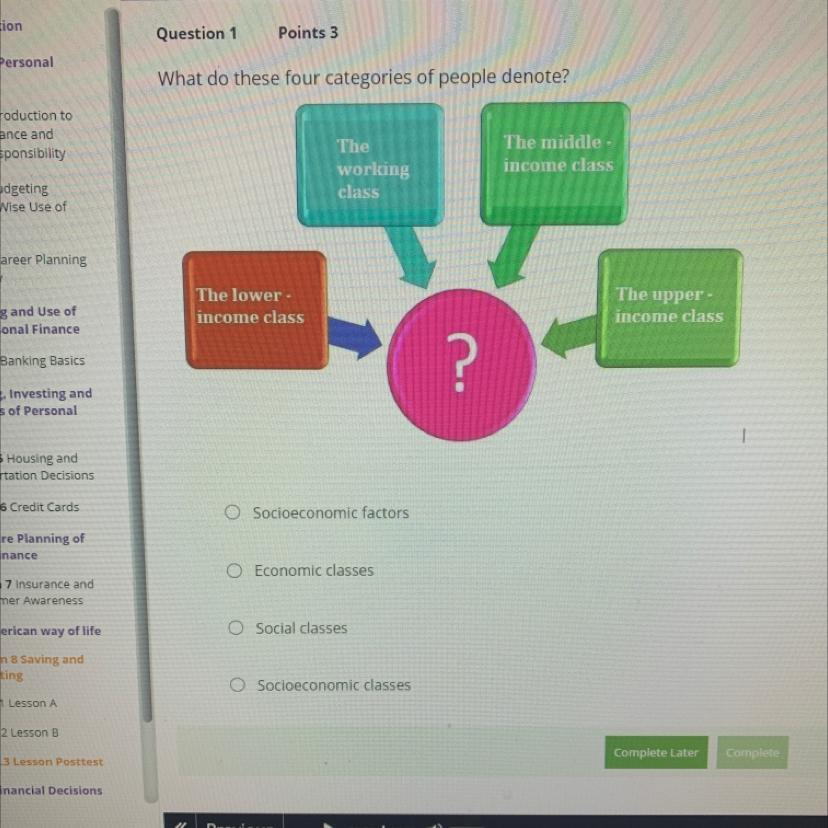

What is the answer?? I need help

Answers

Economic classes

Explanation:

they are all fit within the category about what the main question is

If the income elasticity of money demand is less than 1, then

a. income can never increase faster than money supply

b. an increase in income will be reflected in a proportionately smaller increase in money demand

c. the velocity of money must decrease as the level of income increases

d. an increase in income will be reflected in a proportionately larger increase in money demand

e. changes in the interest rate will never affect money demand

Answers

The correct answer is b. an increase in income will be reflected in a proportionately smaller increase in money demand.

The income elasticity of money demand measures the responsiveness of the demand for money to changes in income. When the income elasticity of money demand is less than 1, it indicates that money demand is income inelastic. This means that the demand for money does not increase proportionately as income increases. In other words, when income rises, the increase in money demand is smaller relative to the increase in income. Individuals and households do not feel the need to hold a higher proportion of their income in the form of money. They may allocate a smaller portion of their increased income to money balances, choosing to spend or invest the additional income instead. This concept is consistent with the idea that as income rises, people tend to allocate a larger share of their income to other assets or consumption goods rather than holding more money. Therefore, the increase in money demand is proportionately smaller compared to the increase in income.

Learn more about elasticity of money demand here:

brainly.com/question/32381641

#SPJ11

Business 2: After apprenticing for another candy maker, I started my first candy business at age 18.

Unfortunately, my first attempt at starting a business (as well as my second) was a failure. After a rocky start,

my third try was more successful - I have just received a fortune from the sale of my caramel business. During

my world travels, I discovered new equipment that makes chocolate and decided to buy it. Today, only the

wealthy can afford chocolate. With this new technology, I think I can make a chocolate that everyone can

afford. In my mid-thirties, I know very little about making chocolate but I am willing to take the time to learn. I

want my life to center on inventing new candies, building this new business, and laying out a new community

that will be a wonderful place for the people I hire to live. I prefer to leave day-to-day operations of the

company–handling production, sales, marketing and distribution—to someone else

Answers

Answer:

The question is incomplete since the requirements are missing, so I looked for similar questions and found that you should advice this client either to form a sole proprietorship, partnership or corporation.

Since this client wants to focus solely on inventing new candies, he would be better off by forming a corporation. That way, he and other stockholders can elect a board of directors which will appoint an appropriate upper management team to run the business.

The other two types of businesses, sole proprietorships and partnerships require that the owners actively participate in managing the business, and that is something that the client wants to avoid. This happens because sole proprietors and partners are personally liable for all the business obligations. On the other hand, corporations are managed by a professional team.

Molly borrows money by promising to make a single payment of $120,000 at the end of 4 years. How much money is Molly able to borrow if the interest rate is 12%, compounded semiannually?

a. $44,656

b. $90,056

c. $76,127

d. $87,080

e. $75,288

Answers

Molly is able to borrow $44,656 if the interest rate is 12%, compounded semiannually.

To find out how much money Molly is able to borrow, we can use the formula for the future value of an investment compounded semiannually. The formula is:

\(FV = PV * (1 + r/n)^(nt)\)

Where:

FV = future value

PV = present value (amount borrowed)

r = interest rate (12% in this case, which is equivalent to 0.12)

n = number of times interest is compounded per year (2 since it's compounded semiannually)

t = number of years (4 years in this case)

Substituting the given values into the formula:

120,000 = PV * (1 + 0.12/2)^(2*4)

Now we solve for PV:

PV = 120,000 / (1 + 0.06)^8

PV ≈ $44,656

Therefore, Molly is able to borrow approximately $44,656.

In this case, the correct answer is a. $44,656.

To know more about investment visit:

https://brainly.com/question/14682309

#SPJ11